5 Ways to Build an Emergency Fund Throughout The Year

An emergency savings account is not just a nice thing to have — it’s a necessity, according to financial expert Sean Stein Smith.

“An emergency fund for an individual or family is a key cornerstone of any financial plan,” says Smith, a financial analyst at Hackensack University Medical Center in Hackensack, New Jersey. “Without an emergency fund, you are putting your family’s financial health at risk.”

An emergency fund, as its name suggests, is a pool of money, usually deposited in a basic savings account, that you can draw from to handle life’s unexpected events, everything from a burst water heater to a furnace that goes on the fritz. It can also help you survive financially if a job loss slashes your regular monthly income.

Why start an emergency fund

Smith, who also works as a Certified Public Accountant, recommends that you have at least three months of daily living expenses saved up at all times. But Smith and others say that more — such as six months of daily expenses — is even better in your emergency fund.

An emergency fund is a necessity no matter how much or how little money you make, says Kim Dula, a CPA and partner at the Marlton, New Jersey, office of Friedman LLP.

“If you don’t have an emergency fund, you run the risk of running up significant amounts of debt if an emergency does come up,” Dula says. “Even if you don’t think you make much money, you can find ways to create an emergency fund. You just have to start slowly and build it up over time.”

That last point is important. Dula says that too many people think that they don’t make enough money for an emergency fund. But that is a fallacy.

Others think that emergencies won’t happen to them, that they’ll never need to draw from an emergency fund.

“They don’t think certain things can happen to them,” says Kary Bartmasser, CPA with Bartmasser & Company in Beverly Hills, California. “Of course, this isn’t true at all. People need to realize that life is very complex and that it can be very hard. By having an emergency fund, though, you can take care of yourself and your family.”

5 ways to Build an Emergency Fund Throughout the Year

It’s not enough to just get started with your emergency savings. Growing it is a big challenge, but it doesn’t have to be hard.

Here are five ways to increase your emergency fund:

1. Pay yourself every month

iStock Photo

Bartmasser says the easiest way to build an emergency fund is to commit to paying yourself something at the end of every month. He recommends clients write a check made out to a savings account that is only designed to hold an emergency fund. Once people get in the habit of doing this each month, it becomes second nature.

The amount isn’t as important as the act of actually paying yourself, Bartmasser says. What if you don’t make a high salary? Strive to write a check for $100 each month. If that’s too high, go for $50. Even if you invest a small amount, and you do it regularly, you’ll steadily build up a fund of emergency savings.

“The physical act of paying yourself first is so important,” Bartmasser says. “It works on the psyche. I am paying myself first. I’m important.”

2. Cut your spending (even just a bit)

iStock Photo

You might think you don’t have enough extra money to create an emergency fund. Smith, though, disagrees. He says that you can always generate extra dollars at the end of the month by cutting back on your weekly spending on non-essentials.

This means skipping a few visits to the coffee shop or the fast-food restaurant each week, he says.

“Try to brown bag your lunch as much as possible,” Smith says. “You’d be surprised at how much you can save.”

Smith says This doesn’t mean you can’t ever spend money on a restaurant meal or hit the movies.

“Budgeting and planning takes work,” he says. “It takes discipline. But it’s important to keep in mind that it’s OK to go out and treat yourself every so often. That helps to keep you motivated.”

3. Make a savings plan

iStock Photo

Dula says so many people fail to create an emergency fund because they don’t track how they spend their money. They then don’t realize that they are spending $100 a month on trips to the noodle shop down the street.

Once people realize how much they are spending, they can then make changes. Instead of spending $100 each month on morning coffee runs, for instance, they can aim to spend just half of that. Then, deposit the $50 a month saved for an emergency fund.

The first step to tracking your regular spending? Create a spending book. In this book, such as a simple notebook, jot down everything you spend your money on for a month. Then, when you get to the end of the month, study where your pennies went. It’s a great way to determine just how much extra money you could have, with a bit of discipline, for an emergency fund.

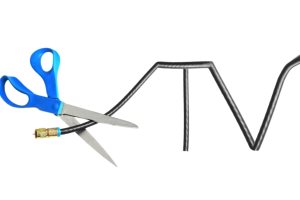

4. Negotiate or cut your bills

iStock Photo

Cable can be expensive. So can your monthly smartphone bill. Consider calling your service providers to ask for lower rates.

These providers want to keep you as a customer. If you ask for a lower monthly fee, they might be willing to compromise, at least a bit. But arm yourself before making these calls. If you find a competitor offering a lower price, mention this information. You’ll put yourself in an even stronger negotiating position if you are willing to walk away from your cable or phone service provider if you don’t get that lower monthly bill.

5. Never skip a month of saving

iStock Photo

It can be tempting to skip that monthly deposit in your emergency fund after a rough month. Don’t do it. Even if you can only afford to invest $25 into your emergency fund, make that deposit. Smith notes it’s more about the routine of these deposits than it is the amount of them.

And even small deposits can add up over time. Look at it like this: If you deposit just $20 a week into your emergency fund, you’ll have a fund of over $1,000 by the end of a year. That’s $1,000 more to keep your head above water amidst costs that may come your way.

More from MoneyRates: