About MoneyRates.

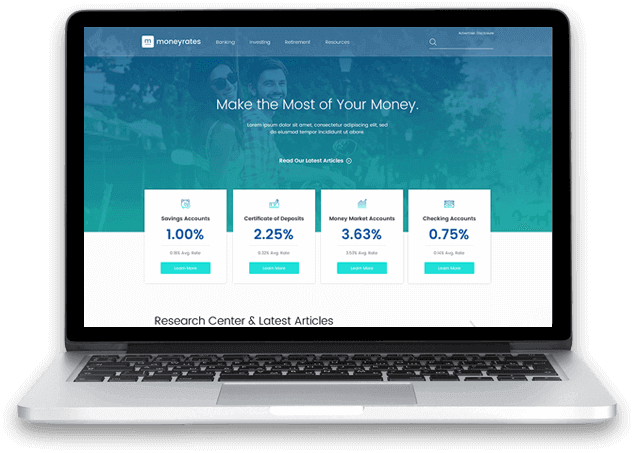

You’re ready to make the most of your money.

- Stay informed about the latest rates for savings accounts, CDs, and money market accounts

- Research and understand the options available to you

- Learn more about how to make the most of your money

Financial Tools

Don’t be intimidated by the math. Our suite of calculators is designed to help take the guesswork out of managing your money. Savings

- Savings Goal Calculator

- Compound Interest Calculator

- Retirement Calculator

Credit Cards

- How much interest are you paying?

- How much could you save with a lower interest credit card?

- How much do you need to pay each month to pay off your credit card?

- How long will it take to pay off your credit card?

Mortgages

- Monthly payment calculator

- Mortgage amortization calculator

- How much house can you afford?

- Should you refinance?

- Advanced refinance

- Loan APR

- Loan comparison

Original Research

Each week we track CD, savings, and money market rates offered from over 400 financial institutions across the country. Using this data, we compile the MoneyRates Index (MRI), a survey of 100 banks (including the 50 largest) in order to determine average national rates.

But there’s more. The MRI also supports MoneyRates features such as:

- Bank Fees Survey, which measures trends in banking fees.

- America’s Best Rates, which identifies top-yielding U.S. bank accounts.

- Best Savings Accounts, which tracks savings accounts over time to highlight high-performing banks.

- Best and Worst States for Banking, which ranks U.S states according to banking conditions.

We Get Excited About Data

Along with the top interest rates for savings and deposit products, our team creates original data-driven articles that explore trends and how they intersect with our lives. We look at demographic and geographic data to see what it can tell us about interesting subjects like how where you live might affect your lifestyle, your job prospects and your retirement. Check out our Research Center for these articles and tell us what you’d like us to explore next!

- Best States to Make a Living / Worst States to Make a Living

- Best States for Retirement / Worst States for Retirement

- Best States for Millennials

- Best States for Young Entrepreneurs

In-Depth Content

Let’s face it. There’s no magic. You don’t come to MoneyRates and instantly make the most of your money. It’s what you learn and put into practice time and again that helps you develop the knowledge and good habits that can make the most of your money.

That’s why we create articles for every stage in your financial journey. As you start to manage your finances, our basic guides can help you learn to balance your checking account and find the best savings account rates.

And when you’re ready to master more complex financial issues, our in-depth content can help you make sense of it all. Explore our Research Center to stay informed on topics such as what the Federal Reserve is doing or how to reduce online brokerage fees.

Expert Advice

The choices we face in life are often more difficult when they impact our finances. That’s when our Ask-The-Expert section becomes a valuable resource. These articles are packed with practical advice based on specific questions gleaned from our readers like:

MoneyRates takes responsibility for the accuracy of the information and the opinions published in its articles, reviews, and research studies. All MoneyRates writers — staff and freelance contributors — must ensure that their articles are fact-based, truthful, and reflect their honest opinions. This approach applies to all editorial content on the site, including research studies, product reviews, investment strategies, and Federal Reserve updates. The opinions expressed on MoneyRates are the author’s alone, not those of the bank advertiser. Editorial content has not been reviewed, approved or otherwise endorsed by the bank advertiser.

If we have made an error, or if our information is misleading, we welcome the opportunity to correct it. Please contact: Editors@MoneyRates to let us know.

MoneyRates does not receive compensation from any company, product or person mentioned in our editorial content, including assessments, unless it has been specifically disclosed in the article.

If we feature an article by a third party — one that does not feature an assessment — we include the word “Sponsored” next to the byline or in another prominent location above the fold. If an advertiser decides to sponsor a page written by one of our writers, the editorial content is strictly ours and reflects the honest opinions of our writers and the research they conducted. In this case, we would also indicate that the article is “Sponsored.”

Site visitors may submit comments on our pages, subject to the conditions posted on our Terms of Use page.

Some of our articles require a specific methodology, and it is useful to understand how we compile and structure the data that forms the basis of our conclusions. Here is the methodology for each of the regular features we promote:

Product Assessments and Rankings

MoneyRates features product rankings in order to help consumers decide which products fit their needs. All of our assessments are based on extensive research and analysis by our MoneyRates team; they are independent of any relationships we have with advertisers. The conclusions represented in our rankings are based on data and the expertise of the MoneyRates editorial team. Details about the methodology used for our each of our assessments are listed below.

Best Savings Account Rates, Best CD Rates, and Best Money Market Account Rates

MoneyRatespiles rates on approximately 1,900 deposit products from over 400 U.S. banking institutions. Rates are gathered weekly from institution websites and from other sources as appropriate. In the gray listings of the account rates table, we feature the rates we have compiled, ranked from the highest to the lowest rates. We feature advertisers in white above those listings.

Best Online Brokers

The MoneyRates study of Best Online Brokers examined 19 prominent online brokers based on seven different criteria: stock trading commissions, maintenance/inactivity fees, account minimums, margin rates, frequency of regulatory incidents, frequency of customer arbitration cases, and research resources. These criteria were sorted into four different categories to determine the best firms for small investors, for margin investors, for having the cleanest disclosure records, and for research resources. Average rankings across these four categories were used to determine the overall rankings of best online brokers.

America’s Best Rates

The MoneyRates America’s Best Rates study is based on the MoneyRates Index, which is a universe of 100 banks structured to represent a cross-section of the U.S. banking industry by comprising 50 of the largest banks, along with 25 medium-sized banks and 25 small banks. Savings account and money market rates applicable at the $10,000 rate tier are collected throughout the quarter and averaged to determine each product’s rate for the quarter. Top ten lists for savings accounts and money market accounts are produced each quarter, and average rankings for the past year are used to determine a list of the best savings and money market account for the new year.