Why I invested in a Gainbridge annuity

When it comes to investing, I tend to prefer a balanced approach — one that blends growth potential with a solid dose of security. This has been especially true the last few years as my husband and I have moved closer and closer to early retirement. While I’m comfortable with stocks and index funds for long-term growth, I’ve also been looking for ways to lock in steady returns for the cash component of our portfolio. That’s what led me to explore fixed annuities—and ultimately, to invest in the Gainbridge FastBreak™ annuity.

The Gainbridge FastBreak™ annuity caught my attention because it offers a simple, short-term commitment with a guaranteed rate that was higher than what I could earn via CDs or high-yield savings accounts. I liked that it came from a trusted company, didn’t require a complicated setup, and allowed me to invest online in just a few minutes.

This Gainbridge annuity review breaks down how the Gainbridge FastBreak™ annuity works, what its pros and cons are, and why I chose it as part of our investment strategy.

What makes Gainbridge FastBreak™ different from other annuities

The Gainbridge FastBreak™ annuity is a fixed, multi-year guaranteed annuity (MYGA) that comes with some non-standard features:

- Fixed interest rates: The Gainbridge FastBreak™ annuity offers a competitive fixed interest rate that lasts from three to 10 years.

- Taxes owed annually: It is non-tax-deferred, meaning interest is taxed annually as it’s earned rather than waiting until withdrawals are made.

- Access funds at the end of the contract: Because it is non-tax-deferred, it avoids the typical IRS 10% early withdrawal penalty for withdrawals before age 59½.

- Early withdrawal options: You can withdraw up to 10% of the account’s value each year without surrender charges or market adjustments (within certain limits).

These features make this Gainbridge annuity much different than traditional annuities. After all, most annuities are designed to provide guaranteed income, typically for retirement. You invest a lump sum or a series of payments, and in return, the insurer guarantees either a fixed rate of return or future income payments.

Traditional annuities also require you to pay a 10% penalty to the IRS if you access funds before age 59 ½, in addition to any income taxes owed on withdrawals. Significant surrender charges also apply with traditional annuities if you sell the contract or access your money too soon.

With the Gainbridge FastBreak™ annuity, however, some of the traditional rules don’t apply. The Gainbridge FastBreak™ annuity lets you lock in a fixed interest rate for three to 10 years, and you can access your investment plus gains at the end of the contract without paying any sort of penalty, regardless of your age.

It’s easy to purchase annuities online with Gainbridge through their digital platform, streamlining the process for customers. However, unlike some providers, Gainbridge does not offer traditional agent support, so you won’t have access to in-person or personalized assistance.

Gainbridge explains how this annuity works on its website:

“FastBreak™ is a high rate savings product that grows your money non-tax deferred meaning you can earn and withdraw your money at any age, unlike most traditional annuities where you can only withdraw your money after 59.5 years old to avoid penalty from the IRS.”

How FastBreak™ compares to certificates of deposit (CDs)

Because the Gainbridge FastBreak™ annuity allows you to lock in a fixed interest rate for three to 10 years and withdraw your investment and gains after the contract ends without incurring any penalties, it functions similarly to a certificate of deposit (CD). The tax treatment of the Gainbridge FastBreak™ annuity also makes it similar to a CD. Instead of having interest tax-deferred, you owe taxes on the interest annually as it is credited to your account, just like with a taxable account.

When comparing returns, the annual percentage yield offered by FastBreak™ is often competitive with, or higher than, what you might find with CDs, depending on the term and current rates.

One major difference between these two accounts is the fact that CDs are FDIC-insured, whereas Gainbridge annuities are not. However, these products are backed by Gainbridge Life Insurance Company, which has an A- (excellent) financial strength rating from the credit rating agency, AM Best.

Why I chose FastBreak™ for my investment over other options

I originally discovered the Gainbridge FastBreak™ annuity when I was comparing CD rates. I found that this annuity works similarly to a CD, but the rates were much higher overall.

While I was initially spooked about the lack of FDIC insurance, I ultimately decided I was comfortable with the annuity being backed by Gainbridge Life Insurance Company. I also wanted to earn the highest return possible on part of our savings, and I knew I wouldn’t need to access this money for several years. Since I was searching for a CD with a three or four-year term anyway, the FastBreak™ annuity’s minimum term of three years worked just fine for my goals. The guaranteed rates offered by FastBreak contribute to fixed and steady growth, making it an appealing choice for long-term financial stability.

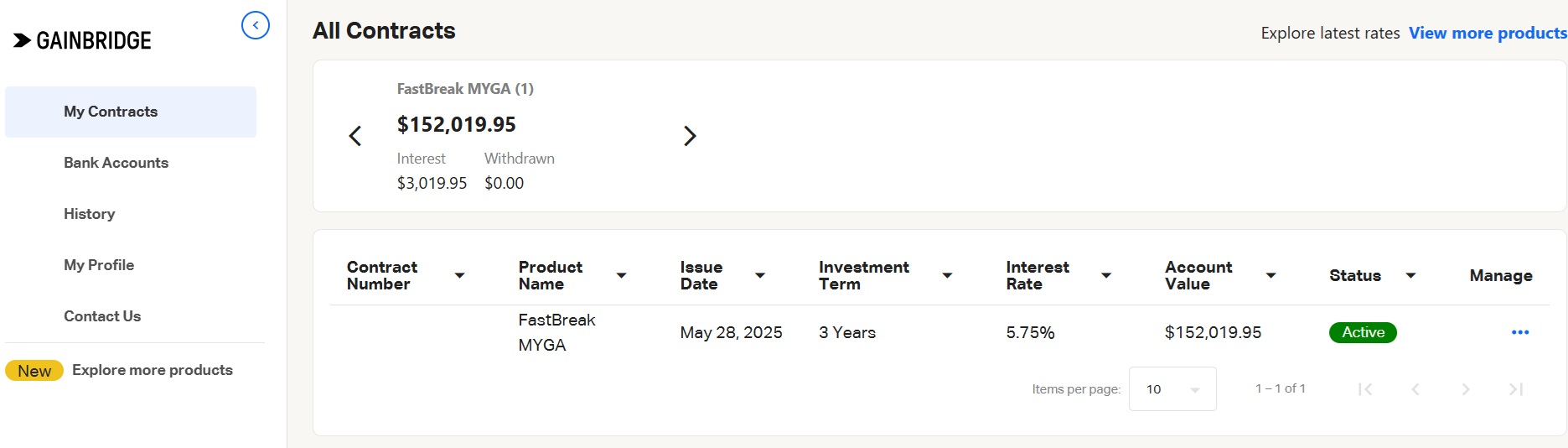

As you can see in the screenshot above, we opened a FastBreak™ annuity with an initial deposit in May of 2025. At the time, we were able to lock in a fixed rate of 5.75% for three years.

Opening an account was easy and required similar steps to opening a CD. To open a Gainbridge FastBreak™ annuity, you have to supply personal information like your full name, address, contact information, and Social Security number (SSN). You then set up an online transfer of the funds you want to use for the annuity, and you sign an insurance contract. The entire process takes less than 10 minutes to complete, and the funds can be growing in your account within a few business days.

Of course, it’s important to know that the FastBreak™ annuity will require a withdrawal charge and a market value adjustment if you withdraw more than 10% of your account value. Amounts withdrawn may also be subject to taxes. There is also a surrender fee if you discontinue the annuity contract early.

Gainbridge FastBreak™ annuity pros and cons

Gainbridge FastBreak™ pros

- Competitive fixed rates: This Gainbridge annuity offers competitive fixed rates that are guaranteed for the contract term.

- Guaranteed growth: Like other MYGAs, FastBreak™ provides guaranteed growth of your principal over the contract period.

- No hidden fees: This account comes free of management fees, administrative fees, or any hidden fees. According to Gainbridge, fees will only apply if you withdraw more than 10% of your annuity value before the end of your term.

- Low barrier to entry: While rates are higher for investments of $100,000 or more, you only need $1,000 to open a FastBreak™ annuity.

- Early access options: You can withdraw up to 10% of account value each year without a penalty, although taxes can apply.

Gainbridge FastBreak™ cons

- Annual taxes: This Gainbridge annuity is non-tax-deferred, which means you get taxed on interest each year as it is earned. For what it’s worth, this is how interest is taxed on CDs as well.

- Limited flexibility: you cannot access most of your funds without a penalty until the end of the contract, except for the option to withdraw up to 10% of your account value annually without charges. Withdrawing more than this allowed amount may result in surrender fees and reduce future income from your annuity.

- Not FDIC-insured: Annuities are offered through insurance companies, not banks. This means they do not come with the protection of FDIC insurance.

- Fewer term options than CDs: While consumers can purchase CDs with terms as short as three to six months, Fastbreak™ annuities are available in terms of three to 10 years.

Conclusion: Why I believe the Gainbridge Fastbreak™ annuity is a smart investment choice

While Gainbridge offers several types of annuities, the FastBreak™ annuity stands out in a few key ways. Because you pay taxes on the interest each year and can access your money at the end of the contract term, it works similarly to a certificate of deposit (CD). Another advantage is the fact that you can get started with as little as $1,000, which is a relatively low barrier to entry.

What really convinced me, though, was that Gainbridge fixed annuity rates are significantly higher than current CD rates. Since I don’t plan to use the funds for several years, earning a few extra percentage points made this annuity an attractive choice for my portfolio.