401(k) Retirement Savings Plan Basics

401(k) plans for saving for retirement are a common employee benefit. They offer you an opportunity for tax-deferred retirement savings and give you access to a range of investment choices. However, what you get out of a 401(k) plan depends very much on what you put into it.

Employer’s 401(k) plan: Your financial responsibility

While your employer may offer you a 401(k) plan, how you use it is largely your responsibility. As the plan’s sponsor, the employer is responsible for finding a competent provider of administrative services and investment options and for facilitating at least a basic level of communication about the plan.

Beyond that, though, the responsibility for using the 401(k) plan falls on your shoulders. This includes figuring out how much you need to save for retirement, putting money enough into the plan to meet your goals, and directing your savings toward the right investment choices. It is a big job, and it starts by understanding the basics of how 401(k) plans work.

9 basics of 401(k) plans you need to know

Here are nine must-know basics of 401(k) investing:

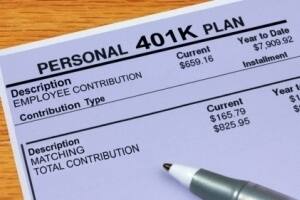

1. Deferral amount

This is the amount of your pay that you choose to direct into the 401(k) plan. These contributions are excluded from the income taxes you normally pay on your wages, and you do not pay taxes on this money or the investment earnings on this money until you make withdrawals from the plan. You may start simply by deferring just what you feel you can readily afford, but before long, you should use a retirement calculator. Figure out how much you should be trying to contribute to the plan to put you on track toward your retirement goals.

2. Automatic enrollment

Your 401(k) plan may have an automatic enrollment feature. This means that a certain percentage of your pay is automatically directed into the plan unless you opt-out. Do not mistake automatic enrollment deferrals for a recommendation of how much you should be putting into the plan. They are generally considered a bare minimum just to help employees get started, but you will likely have to contribute more to adequately fund your retirement.

3. Matching contribution

Your employer might match a portion of the contributions made to the 401(k) plan. This is extra compensation available to you just by participating in the plan. If your plan has this kind of matching feature, you should strive to contribute at least enough to take full advantage of it so you do not miss out on this extra money.

4. Contribution limit

For most 401(k) plans, the contribution limit was set at $18,000 for 2016, according to the IRA, with future limits likely to be adjusted for cost-of-living changes. Highly compensated employees might be subject to stricter limits, depending on overall participation levels in their plans.

5. Penalty for early withdrawal

Except under extreme circumstances, any withdrawals from the 401(k) plan prior to the age of 59 1/2 are subject to both the ordinary income tax you would owe on that money plus a 10 percent penalty. However, you can roll your 401(k) balance into another qualified retirement plan without tax consequences.

6. Investment choices for 401(k)

This is the line-up of investment choices offered by your plan, and you will have to pick where on this selection you want to direct your 401(k) retirement savings. Typically, these choices will represent a range of different risk levels and investment styles.

7. Asset allocation

While the investment menu may offer a great many detailed investment choices, what is most important is the big-picture decision you make about asset allocation – how your money is split among stocks, bonds, and other asset classes.

8. Life-cycle or target-date options

If you do not feel comfortable making your own asset allocation and investment choices, you should look to see if your plan has life-cycle or target-date options. These allow you to pick an option based on your age or planned retirement date, and the manager of that option will pick investments generally suited to people with a similar time horizon.

9. Fund/investment fees

Pay close attention to the fees of any investment option you pick. Investment fees in excess of 1 percent can significantly reduce your returns.

That may sound like a lot of information to master, but if you pay regular attention to your 401(k) plan, you will become familiar with it over time. It is worth the effort. The results you get from your 401(k) plan depend not just on how much money you invest in it but also on the thought you put into it.