What happens when a bank branch closes: Complete guide for customers

Financial planning involves preparing for a lot of “what if” questions. Because of recent banking trends, one of the questions you should think about is “what happens if my bank branch closes?”

This is part of a broader trend in the banking industry, where the shift toward digital banking and the decline of physical branches are impacting both accessibility and the way consumers interact with their banks.

For a growing number of bank customers, this has become more than just a theoretical question. The total number of bank branches in America has declined in 11 of the past 12 years. Major banks like Wells Fargo have played a significant role in this trend, closing many branches nationwide and affecting access to banking services for consumers. If you still bank at a local branch, you should prepare for the possibility that this could happen to you.

Here’s the good news – even if your bank branch closes, you still have lots of options. The rise of online and mobile banking provides convenient alternatives for most banking transactions. Also, despite the huge number of branch closures in recent years, technology has made banking more accessible than ever.

This article will explain what happens when a bank branch closes and outline the steps you should take in response. While a branch closure can feel disruptive, it can also present an opportunity to reassess your personal finance needs and explore banking options that better suit your lifestyle. Understanding the implications of a branch closure and preparing accordingly will help safeguard your financial well-being and ensure continued access to banking services.

Local bank branches are rapidly being boarded up

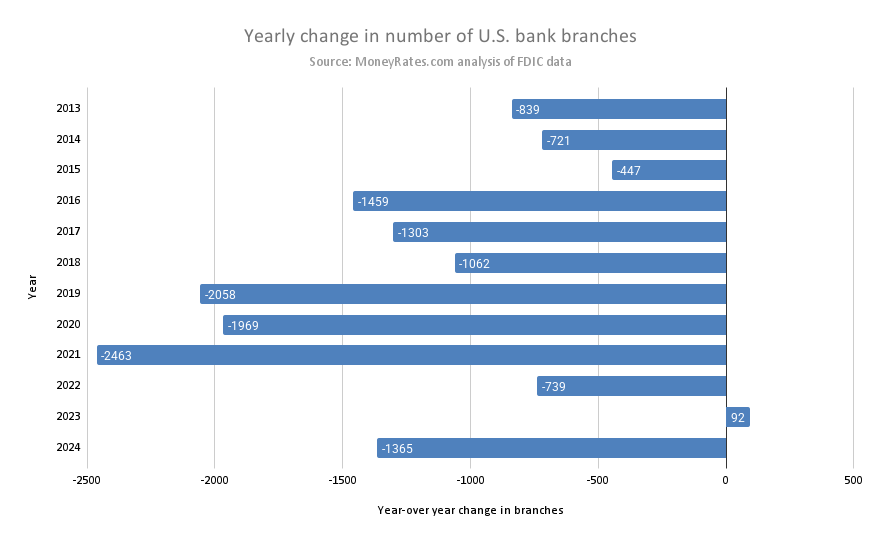

According to Federal Deposit Insurance Corporation (FDIC) data, the total number of U.S. bank branches peaked in 2012. Since then, the number of physical branches—including traditional brick and mortar locations—has declined in every year but one:

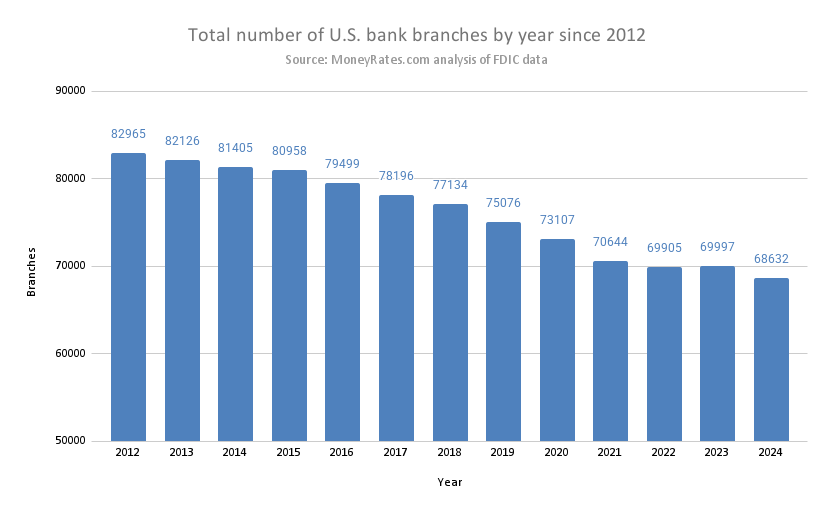

These closures add up to a net total of 14,333 fewer branches since 2012. Viewed by itself, that’s a shocking number. Still, when you look at the number remaining, it’s clear that brick-and-mortar branches are far from extinct. According to global market intelligence data, the industry continues to see a significant presence of these locations:

In short, even with a loss of over 14,000 branches in a dozen years, there are still over 68,000 branches left. That means that, for now at least, branch banking remains an option for many in much of the country.

However, the trend of banks closing branches has accelerated, and many Americans might soon get word that their local brick-and-mortar branch has been closed. In areas that are not heavily served by banks, this may mean that in-person banking is no longer practical.

Why bank branches are closing

So, why is America losing so many bank branches? There are a few forces at work: Declining demand for in-person banking services has played a significant role, as more customers choose digital options over visiting physical locations.

Mergers and acquisitions have also led to consolidation, with some branches closing as banks combine operations. The shift to online and mobile banking has made it easier for customers to manage their accounts remotely, reducing the need for a large network of physical branches.

These trends are being shaped by financial institutions adapting to new technologies and changing customer preferences. As the banking landscape evolves, consumers should regularly assess their financial needs to ensure their chosen services and providers continue to meet their requirements.

The digital banking revolution

Digital banking has made access to accounts available through computers and mobile devices. As a result, online banking and mobile banking have rapidly grown in popularity, offering convenient alternatives to traditional branch visits. Features like mobile deposit, bill pay, and easy account management have contributed to the shift, making bank branches less necessary than they once were. The American Bankers Association found that just 8% of Americans still regularly visit a bank branch.

With that being the case, branches are a prime target for cost cutting. Why would a bank pay to own or rent real estate, maintain the physical space, and staff the branch if fewer customers are banking in person these days?

New competition from fintech companies

Financial technology companies, known as Fintechs, are companies that are not registered as banks, but use technologies to deliver services from banks to customers. This new form of intermediary has attracted customers away from traditional banking.

Not only does that mean there are fewer in-person customers for banks to service. It also increases competition, causing banks to take a hard look at unnecessary costs like underused branches. Online only banks are also emerging as strong competitors to traditional banks, offering digital services without physical locations.

Consumers should shop for the best banking options by comparing features, rates, and perks before making a decision.

The banking industry is consolidating

Possibly the most important cause of the decline in bank branches is that the industry is rapidly consolidating.

Today, there are 2,144 fewer banks than there were in 2012. That represents a decline of more than one-third of the total.

This isn’t due to a massive number of bank failures. Only 78 of the 2,144 reductions in banks were because a bank failed. Far more often, mergers and acquisitions have driven the decline in the number of banks. The process of mergers and acquisitions typically involves evaluating overlapping operations and deciding which branches to keep or close.

When banks merge with or acquire other banks, one of the things they look for is how they can make the combined operation more efficient. For example, if two banks have branches on the same city block and the banks merge, they may decide to keep just one of those branches. Bank branch closures often follow these mergers, impacting local communities and reducing access to physical banking services.

So, the decline in the number of banks is not a sign of weakness for the banking industry overall. In fact, over the past dozen years total deposits at U.S. banks are up by 82%. However, as the industry seeks efficiency by consolidating and closing branches, it means more of those deposits are concentrated at fewer banks and branches.

Given the competitive and economic forces driving this, branch closures may continue to be a common occurrence in the years ahead. That’s why it’s so important to know what to do if this happens to you. If you decide to switch banks after a merger or closure, you may be able to find better rates on deposits or loans by exploring other financial institutions.

Steps to take when your bank branch closes

Here’s what happens if your bank branch closes, and how you should respond. We’ll also outline the next steps you should take to ensure a smooth transition after the closure:

How you’ll be notified

Banks are usually required to mail you a notice at least 90 days in advance if your bank is closing, and this notice will include the proposed closing date. The bank is also required to post a notice at the physical location of the branch at least 30 days in advance.

The bank’s notification process may vary slightly if the bank is simply shifting the location of the branch to another building in the same neighborhood. In any case though, the bank is obligated to give you notice. Also, that notice should provide information about how the bank plans to service accounts formerly housed at the branch.

Essential first actions

Once you receive notice of a branch closure, the clock has started clicking. You shouldn’t lose any time figuring out how it affects you and what to do about it.

So, promptly take the following steps:

- Read the notice from the bank carefully. You may also be able to find additional information online. Banks typically don’t want to just leave their customers hanging. They’re likely to have a plan for how their accounts will be handled. Think about whether that plan suits your needs, and check how your transactions will be managed after the closure.

- Determine the nature of the branch closing. It makes a difference whether your bank will still exist or whether it’s being swallowed up by another bank. Note that even in the case of bank failures, the FDIC arranges for a successor bank to take over for the failed bank. However, if the bank you formerly dealt with ceases to exist, it’s going to mean more significant changes than a simple switch of branch locations.

- Check if the bank has offered a readily available alternative. Again, banks will typically provide some guidance on how your account will be handled. If the plan is for accounts to be serviced by a remaining branch of the same bank that’s just a few blocks away, the change may be no big deal. However, if it means going to another town or dealing with a different institution, it may be a less satisfactory solution.

- Contact the bank with any unanswered questions. The bank notice may not provide all the information you need. Get any questions answered before the branch closes. It may be much tougher to track down answers afterward. Confirm how you can access your funds and how to withdraw money if needed.

- Re-examine how you bank. As disruptive as a branch closure is, it may also be a helpful prompt to take a fresh look at how you bank. Consider whether it’s still important for you to bank in person, or if you prefer the convenience of banking online. Think about how well the bank’s products and services have been meeting your needs. It may be time to look for better alternatives. Make sure to manage your old account by updating all automatic payments and bills to avoid missed payments or disruptions.

You can continue banking through online services, ATMs, or by switching to another financial institution to ensure uninterrupted access to your accounts and services.

Your accounts and services: What happens if your bank branch closes

As mentioned above, a key question is whether your bank is remaining in business or is being taken over by another institution. It’s more disruptive if the change is going to result in you dealing with another institution. When this happens, it’s important to understand your bank accounts and any minimum balance requirements that may change, as these can affect fees and access to account benefits.

After a closure, be sure to review your bank account features to ensure they still meet your needs and to understand any new terms or requirements.

Checking and savings accounts

If you’re dealing with the same bank, nothing about your accounts is likely to change as a result of your branch closing. Account numbers and terms like fees, interest rates, minimum balance, and minimum deposit requirements should all remain the same unless you’re notified otherwise.

However, if your bank has been taken over by another entity, two important numbers may change:

- The routing number. Basically, this is the bank’s electronic address. It’s a crucial piece of information for directing money to your bank, such as direct deposits of paychecks.

- Your account number. This is the key identifier that makes sure transfers flow in and out of the right account.

If you’re dealing with a new bank, you may have to sign a new account agreement. You may also have to reset any automatic payment and direct deposit instructions. After a branch closure, it’s also important to check if online bill pay is still available for managing your payments efficiently.

FDIC insurance

If your bank is acquired by or merges with another bank, your FDIC insurance should remain intact. However, the extent of your coverage may be affected if you already have an account at the acquiring bank, as the bank’s FDIC insurance coverage applies to all your accounts at the institution.

FDIC insurance covers each depositor for up to $250,000 at any financial institution, playing a crucial role in deposit protection. Even if your money is in different accounts, it all counts towards the $250,000 coverage limit.

So, let’s say you had a $200,000 account at bank A and a $200,000 account at bank B. Bank A has been acquired by Bank B, so now both accounts are at bank B. You now have a total of $400,000 at bank B, but only $250,000 of it would be covered by FDIC insurance.

In that case, you may want to consider moving some of your money to a different bank to make sure it’s all covered.

Safe deposit boxes

If you have a safe deposit box, it’s important to determine the bank’s plan for that box if you get notice that your branch is closing.

The bank may have a plan for automatically transferring the box to a new location. Or, they may require you to empty out the box before the branch closes. You should get this information in writing.

Loans and mortgages

Loan and mortgage terms should remain unchanged if your branch closes, even if the loan is taken over by a new bank.

However, if it’s a new bank, it may be dealing with a different loan servicer. That means information about where to send payments and how to get information may change. It’s important to get these updates before your branch closes.

Finding alternatives after a branch closure

If your branch is closing and you’re not happy with the new arrangements your bank has made, you have some alternatives. When faced with a branch closure, it’s important to evaluate your current banking relationship and consider whether switching banks might better suit your needs.

If you decide that your current provider no longer meets your requirements, you can switch banks by following a few simple steps provided by most institutions.

Finding a new local branch

If you’ve been banking in person, it’s important to check if there’s a nearby branch of your bank that’s convenient for continuing in-person services. Additionally, explore accessible ATMs in your area, as they provide convenient access to your funds without needing to visit a branch. Keep in mind that using ATMs outside your bank’s network may result in higher fees, so it’s wise to confirm which ATMs are fee-free for you.

Digital banking options

If it’s no longer convenient for you to visit a branch of your bank, go to their website and see what digital banking tools they offer. Many banks provide strong ATM access, allowing you to perform essential transactions like withdrawals and deposits even when branches close.

In recent decades, many American bank customers have made the transition to digital banking, with online and mobile banking offering convenience for most transactions. A branch closing can be a good opportunity to see if this might suit your needs as well.

Considering a new bank

Another opportunity a branch closing can represent is to see whether another bank might better meet your needs. Take this chance to compare your current bank to alternatives, evaluating which institution offers better services, features, and overall value.

Consider how well your bank has met your service needs – and whether it can still do that with your branch closing. Also consider the terms on your accounts. Do some comparisons of fees and interest rates with other products to see how competitive your bank is. Make sure your funds will remain accessible during any transition, and look for cash incentives or bonuses that some banks offer to new customers.

Changing banks can be disruptive. If your bank is being taken over by another institution, you may have to go through some of that anyway. Even if it isn’t, the change in branches may force you to change your banking habits.

Bottom line: If a branch closure is forcing you to change the way you bank, you might as well see if finding a different bank could earn you some extra interest or save you money on fees.

Which banks have the best savings account rates?

Finding the online bank with the best savings account to meet your needs is as simple as using our search tool. Try it now and find a savings account that works for you.

Frequently asked questions about what happens when a bank branch closes

It’s important to remember that most customer money isn’t physically located at branches. If your branch is closing but your bank still exists, nothing about how your money is handled should change. If your bank is being taken over by another institution, the transfer should automatically happen digitally.

If your bank is remaining in existence, probably not. However, if your bank is being taken over, the routing and account numbers are likely to change.

If your bank is remaining in existence, you should be able to continue to use your checks. However, if the bank is taken over by another bank, you are likely to need new checks. If they don’t provide instructions about handling this when they notify you of the closure, you should find out about it before your branch closes.

Not if they are branches of the same bank or ATMs that are part of a network your bank belongs to. However, using out-of-network ATMs can result in significant fees.

If your bank is remaining in existence, nothing should change. If another bank is taking over your account, you may have to renew your automatic bill payment instructions. Also, if you use direct deposit, make sure your employer has the new routing and account numbers if those have changed.

It should not affect the terms of your loans, but it may affect the servicing instructions. As for credit cards, a branch closure shouldn’t affect them unless the bank has been taken over. If you’re dealing with a new card issuer, the accounts may transfer automatically, but you should be alerted to any changes in terms that might result.