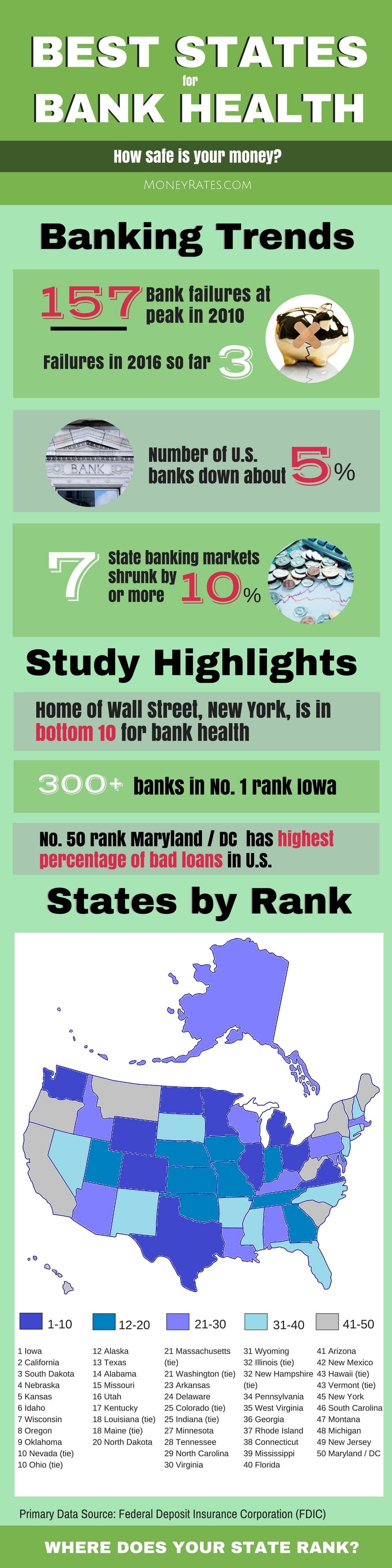

Best and Worst States for Bank Health 2016

- The number of U.S. banks is down almost 5%, but bank failures have slowed down.

- With over 300 banks based in the state, Iowa has the fourth-greatest number of banks of any state and is the healthiest state for banking in the U.S.

- Maryland/District of Columbia is the most unhealthiest banking state in the country, with about 1.31% of loans non-current, compared with a national average of 0.77%.

How safe is your money? If you have checking and savings accounts or certificates of deposits (CDs), your funds could be at risk if they’re not properly protected and banks fail.

The financial crisis that sparked the Great Recession is starting to fade into the background, and bank closures have slowed from a torrent to a slow drip. Does that mean the banking system has been fully restored to health?

It depends on where you look. A MoneyRates analysis of banking conditions in all 50 states found that overall bank health varies from one area to the next. To demonstrate these extremes, MoneyRates has compiled a list of the best and worst states for bank health.

Trends in Bank Health and Failures

Analysis of FDIC data showed several key trends in banking:

Fewer bank failures

One clear trend that emerged from this analysis is that the market is shrinking, but not necessarily due to bank failures. U.S. bank failures have slowed from a peak of 157 in 2010 to just three so far in 2016.

The number of US banks is down almost 5 percent

Bank failures may be rare these days, but consolidation through mergers and acquisitions also reduces consumer choices. In some cases, this may be a sign of financial distress. Whatever the reason, the number of banks in the U.S. has decreased by 297 over the past year, a decline of 4.86 percent.

Banking markets are significantly smaller in some states

Seven states have seen their banking markets contract by 10 percent or more in the last 12 months.

Methodology

There are a number of ways to look at the health of banks. A thriving and diverse marketplace of banks for consumers to choose from is one way to look at it. The quality of bank loans is another way, and the potential exposure of banks to financial shocks is a third significant aspect of bank health.

To view state-by-state banking markets from all these angles, MoneyRates analyzed data from the FDIC to rank states based on the following criteria:

- The size and rate of change of the banking population in each state

- Tier 1 financial leverage. A few years back, international banking guidelines set a minimum standard of 3.0 for the ratio between a bank’s financial resources and its potential exposures. At 10.48, the average for US states easily exceeds this standard

- The percentage of bank loans that are non-current

The size and rate of change of the banking population varies greatly from state to state, as do statistics on financial leverage and bad loans. Considering all these factors, the following lists of the best and worst states for bank health were produced.

Top 10 Best States for Bank Health

Here are the top states for bank health:

1. Iowa

You may not think of Iowa as a major banking center, but with over 300 banks based in the state, it is home to the fourth-greatest number of banks of any state. Like most states, Iowa’s banking market is shrinking, though at a slower rate than the national average. Iowa’s tier 1 financial leverage is slightly better than the average state’s and has the fourth-lowest percentage of non-current loans.

2. California

California was one of the states badly hurt by the real estate collapse, but the housing market has largely recovered, and California’s banking industry now looks very healthy. California is one of the 10 best states for tier 1 financial leverage and has one of the 10 lowest percentages of non-current loans.

3. South Dakota

This is a relatively small banking market, but its institutions look particularly healthy. South Dakota’s tier 1 financial leverage ratio is better than the average, and it has one of the lowest percentages of non-current loans.

4. Nebraska

Like Iowa, this is a state that might surprise people by having an above-average number of banks based there. What is especially significant about Nebraska’s banking market is that it has the lowest percentage of non-current loans of any state. Just 0.27 percent of loans by the state’s banks are not up to date – well below half the national average.

5. Kansas

This state is in the top 10 for the number of banks headquartered there, and the size of that market is contracting more slowly than in most states. Kansas also has one of the 10 lowest percentages of non-current loans.

6. Idaho

This is one of the smaller banking markets in the nation, but it is stable. Idaho has no net change in the number of banks headquartered there over the past year. Idaho scores well for having a small percentage of non-current loans, but its main strength is having one of the country’s 10 best tier 1 financial leverage ratios.

7. Wisconsin

With over 200 banks based there, Wisconsin has a fairly robust banking market. An important strength of these banks is that, on average, they have one of the country’s top 10 tier 1 financial leverage ratios. That strong financial position might be useful because the state’s banks have a slightly worse-than-average percentage of non-current loans.

8. Oregon

This is one of the smaller banking markets in the nation, but it’s also one of the sounder ones financially. The average tier 1 financial leverage ratio in Oregon is above average. Additionally, the percentage of non-current loans is among the 10 lowest in the U.S.

9. Oklahoma

This is one of the top 10 states for the number of bank headquarters. Oklahoma’s tier 1 financial leverage is about average, but its percentage of non-current loans is better than in most states.

10. Nevada (tie)

As part of a tie for tenth place, Nevada’s ranking is an encouraging sign after how much the state’s financial institutions suffered as a result of the banking crisis. Perhaps this is a case of survival of the fittest because Nevada now has a very low number of banks, but they are unusually healthy in aggregate. The state’s tier 1 financial leverage ratio is the second best in the nation, and its percentage of non-current loans is among the 10 lowest.

10. Ohio (tie)

Though tied with Nevada, Ohio’s characteristics are very different. It is one of the 10 largest banking markets in the nation, and that market is contracting more slowly than average. Tier 1 financial leverage in the state is better than average, though it does have a slightly higher percentage of non-performing loans than the typical state.

Top 10 Worst States for Bank Health

Here are the 10 worst states for average bank health:

1. Maryland/District of Columbia

The FDIC includes the District of Columbia with Maryland for the purpose of its statewide banking statistics, so the two are combined here, but the results are not good. Most worrisome is the highest percentage of bad loans in the country. About 1.31 percent of loans made by Maryland/DC banks are non-current, compared with a national average of 0.77 percent.

If 1.31 percent does not sound that bad to you, keep in mind that today’s very low interest rates leave banks little margin for error. That dismal loan performance may be a big reason this area’s banking market shrunk by 12.7 percent last year.

2. New Jersey

Only eight states have a tier 1 financial leverage ratio below 10, and New Jersey is one of them. Other problems include a banking market that is shrinking faster than average and a percentage of non-current loans worse than in most states.

3. Michigan

Cities like Detroit and Flint have had well-documented economic problems, and these struggles may be affecting the banking community. Michigan ranks among the 10 worst states for both tier 1 financial leverage ratio and percentage of non-current loans.

4. Montana

This is one of the 10 worst states for the percentage of bad loans. It also ranked below average on each of the other measurements used in this study.

5. South Carolina

As with Montana, this was one of the 10 worst states for the percentage of bad loans. With every other measurement a little below average, there were no strong areas to pull its score up.

6. New York

As the home to Wall Street, New York is a renowned financial center, so seeing it in the bottom 10 for bank health is a little surprising. The main culprit is the state’s average tier 1 financial ratio, which is the fifth lowest in the nation.

7. Vermont

This is one of the nation’s smallest banking markets, and the state ranked dead last for average tier 1 financial ratio.

8. Hawaii

This is the nation’s second smallest banking market (only Alaska has fewer banks). The state’s average financial leverage ratio is among the worst states, though on the plus side, Hawaii has one of the 10 lowest percentages of non-current loans.

9. New Mexico

The primary problem is New Mexico is one of the eight states with a tier 1 financial leverage ratio below 10.

10. Arizona

What stands out about Arizona is it is a small banking market that is rapidly getting smaller. The number of banks based in the state shrunk by 22 percent last year, the fastest rate of contraction of any state.

FDIC Insurance Limits and Protecting Your Bank Deposits

The above should indicate where trouble in the banking industry is most likely to flare up. However, consumers should remember that individual institutions vary greatly from the state average, and financial conditions can change quickly.

Regardless of how healthy banking seems to be in your state, the best way to protect your deposits is to make sure you are fully covered by FDIC insurance. Keep in mind that FDIC insurance limits – typically $250,000 per depositor – applies across all the deposits you have at a given institution. If your accounts total more than that, you should spread deposits around to different banks.

Banking conditions have improved considerably since the financial crisis. But, as the contrast between the best and worst lists shows, some states have made more progress than others. That’s why the backstop of FDIC insurance coverage remains critically important.

Best States for Bank Health Infographic

Overall Rank of States for Bank Health

Didn’t see your state in the best and worst lists above? Here is the full list of states and where they rank: