America’s Best Rates Q2 2015: Persistently Low Bank Rates Call for Action By Consumers

- The average savings and money market rates in the MoneyRates America's Best Rates survey have hovered below 0.20% for 2 years.

- The average savings account rate dropped from 0.171% to a new low of 0.160%.

- 8 of the top 10 savings account rates are offered by online accounts, and the average online savings account rate is 0.552%, compared to an average of 0.074% for branch-based accounts.

Bank depositors would be wise to search for higher rates themselves rather than wait for rates across the board to start to rise after another quarter of rates stagnating near zero, according to the latest MoneyRates America’s Best Rates survey. The study, which measures the levels of savings account and money market account rates in the U.S., shows the best deals for savers looking to switch to a better bank for their deposits.

Higher rates? We’ve heard that one before

So far, all the talk about interest rates heading higher is mostly just that – talk. Throughout this year, speculation has been rampant that the Federal Reserve might finally be ready to raise interest rates, and the board may yet do so in the weeks or months ahead. After all, economic conditions would certainly indicate that the time has come. The inflation rate, which slipped into negative territory around the turn of the year, has now been solidly positive over the past five months. Employment growth has averaged a quarter million new jobs per month over the past year, driving the unemployment rate down to 5.2 percent as of July 2015.

These indicators are significant because more solid inflation and lower unemployment are the conditions routinely cited by the Fed as necessary before the board will raise rates. Promising though they may be though, until rates actually start to rise, economic indicators are of little comfort to depositors earning virtually nothing on their saving and money market accounts.

The average savings and money market rates in the MoneyRates America’s Best Rates survey have been below 0.20 percent for two years now. For consumers who are tired of waiting for good news on rates, at least there are some savings and money market accounts that stand out from the crowd and offer something a little better than the average.

Top 10 best saving account rates

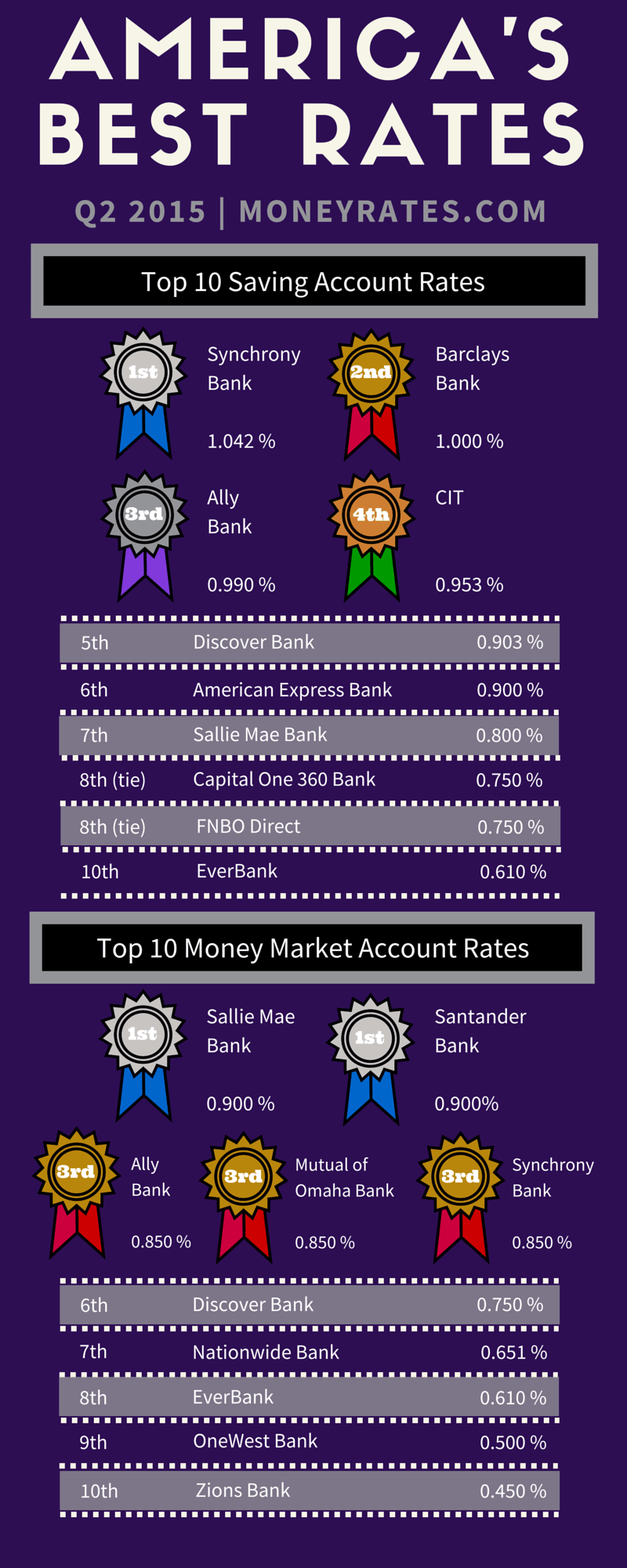

Here are the top 10 savings account rates in the second quarter America’s Best Rates survey:

Overall, the average savings account rate dropped from 0.171 percent to a new low of 0.160 percent. Rates either dropped or stayed the same in every sub-category of savings accounts – online and traditional branch-based accounts, as well as accounts at large, medium, and small banks.

Even though they could not escape the trend toward lower rates in the second quarter of 2015, online accounts remain the most likely place to find higher savings account rates. Eight of the top 10 savings account rates are offered by online accounts, and the average online savings account rate is 0.552 percent, compared to an average of 0.074 percent for branch-based accounts.

Top 10 best money market account rates

Here are the top 10 money market accounts in the second quarter America’s Best Rates survey:

Money market rates held up a little better than savings account rates in the second quarter, as the overall average actually rose ever so slightly to 0.159 percent. This now makes the average money market rate virtually identical to the average savings account rate of 0.160 percent.

As with savings accounts, online accounts are the best place to look for higher money market rates. The average online money market rate was 0.550 percent, compared to 0.102 percent for branch-based accounts. Branch-based accounts are better represented in the top 10 money market rates than in the top 10 savings account rates, as only six of the 10 top money market rates are from online accounts.

Why actively shop for better rates

Several years into this era of low interest rates, waiting for higher rates has become tiresome for consumers. However, rather than waiting passively for rates to rise, consumers can benefit from actively shopping for higher rates. The top savings account rate in the survey is more than six times the average rate. The top money market rate is more than five times the average.

The America’s Best Rates survey is conducted quarterly, based on the MoneyRates Index of 100 banks representing a mixture of large, medium, and small institutions. While this does not encompass all banks, it captures a significant portion of the total dollars on deposit, as well as a cross-section of different bank sizes.

What’s your bank? Are your savings or money market account rates better or worse than the ones in the survey?