5 Common Events Leading to Money Troubles – What to Do

Dr. Padawer, senior vice president for product innovation at Progrexion, a company that helps consumers regain control of their credit narratives by addressing some of the lasting damage that financial problems cause to their credit reports. What is striking is how often those problems result from situations that millions of Americans encounter every year.

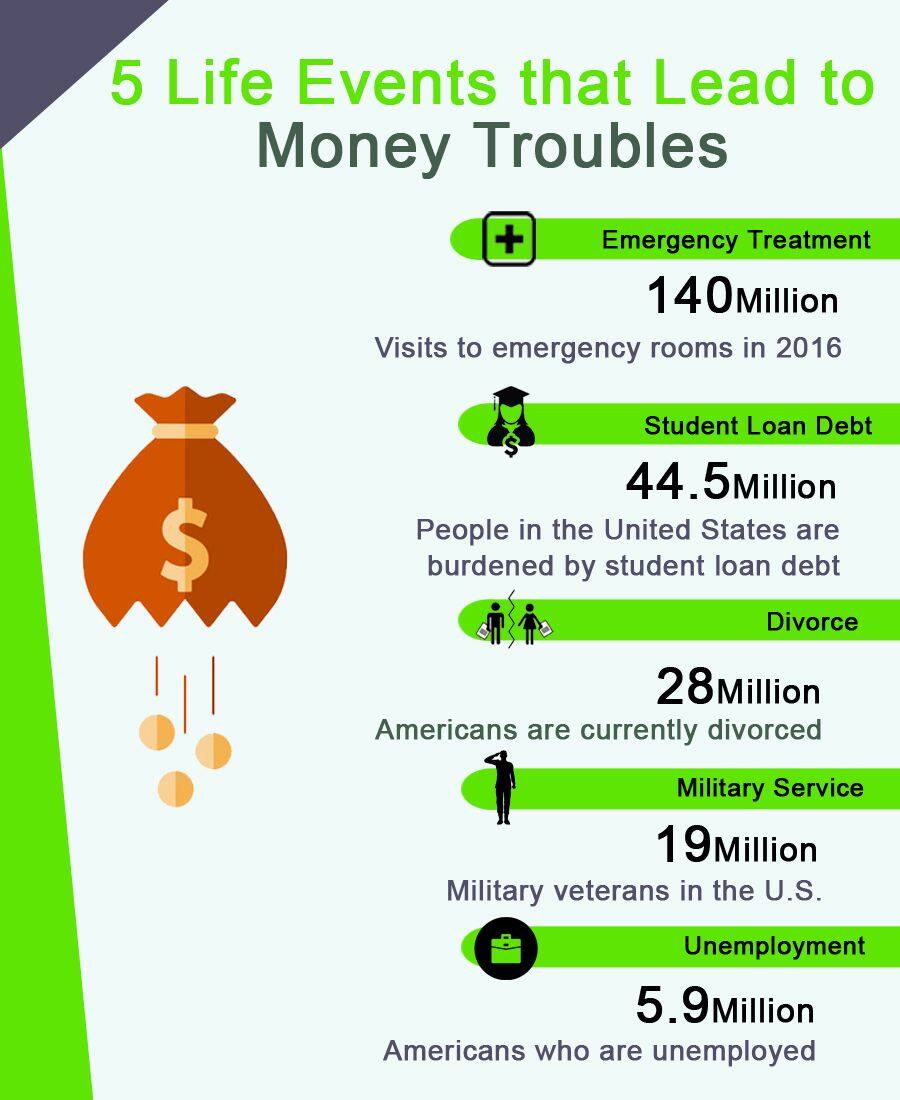

In an extensive interview with MoneyRates, Dr. Padawer outlined five common causes of money troubles:

- Divorce

- Military service

- Student loans

- Emergency medical treatment

- A period of unemployment

By understanding the potential implications of these circumstances, you can better avoid having them lead to trouble in the first place and better cope with any credit problems should they occur.

1. Divorce and new debt responsibilities

Over 28 million Americans are currently divorced, and that does not even include those who are divorced and remarried. According to Dr. Padawer, a divorce can often lead to unpleasant surprises on a credit report.

“Divorce always presents unintended financial outcomes for both parties,” he says. “They don’t anticipate the cascading impact of how one spouse’s financial behavior will continue to impact the other, even after the divorce is finalized.”

Although a divorce decree assigns future responsibility for a debt to one of the parties in the divorce, there is generally no direct communication of this between courtrooms and financial institutions. As a result, a creditor may continue to hold both parties responsible for any debt outstanding.

Solution: Be sure to formally communicate to creditors how the court has assigned responsibility for debts incurred during the marriage, even if the lead responsibility for that debt rests with your spouse.

According to Dr. Padawer, it can often take professional intervention to get the message across. “The issue needs to be framed clearly and powerfully to the creditor,” he advises. “This includes getting the financial institution to stop credit reporting on obligations that are no longer the responsibility of one of the ex-spouses. It may also involve getting them to rescind prior reporting.”

It is also advisable to step up monitoring of your credit report in the aftermath of a divorce to make sure no actions by your ex are continuing to affect your credit history.

2. The price of military service

There are over 19 million military veterans in the U.S. and 1.29 million active service members. Combined, that means over 20 million Americans have served or are currently serving in the military. Unfortunately, that service can lead to financial problems.

Dr. Padawer observes: “The very act of selflessly serving our country can incur financial penalties that are practically always unexpected. These are often very young people who lack financial experience.”

A common problem is that being deployed overseas can make it difficult to keep up with your bills. Dr. Padawer points out that often, military personnel may not be in a position to receive mail for long periods or may not be able to disclose their addresses for security reasons. Under those circumstances, it’s easy for payments to fall behind.

“People come home to find assets defaulted and their credit ratings shattered,” notes Dr. Padawer.

Solution: Someone who encounters such problems due to military service needs to be aware of the Servicemembers Civil Relief Act. This federal law provides several financial protections to people who fall behind on their obligations due to military service, including:

- An interest rate cap on debt incurred prior to military service

- The ability to delay civil court proceedings

- Protections in connection with default judgments

- Protections in connection with lease terminations

- Protections in connection with evictions, foreclosures and installment contracts such as car loans

Being aware of these rights can give you a much stronger hand when dealing with creditors and credit reporting agencies.

3. Education debt

Currently, 44.5 million people in the United States are burdened by student loan debt. Education is seen as an investment in the future, but it can be prohibitively expensive in some cases.

The dollar cost is compounded when inaccurate credit reporting leads to damaged records that can increase the cost of credit to young adults, prevent them from getting a mortgage or other loans, or even complicate the ability to get a job and an apartment.

Even students who have made every effort to keep up with their obligations find black marks on their credit records. How? Dr. Padawer explains:

“With people often starting and stopping their education, periods of forbearance and deferment are critical, and often the reporting does not acknowledge these periods. We have found that no one is worse at keeping their credit reporting straight than colleges and universities. They aren’t all bad, but many are.”

Solution: Since student loans don’t start coming due until a person has left school, students need to carefully document everything to their colleges and creditors, including start dates, completion dates, and when breaks from attending college are temporary.

It’s also a good idea to begin monitoring your credit report even before you have any plans to apply for credit. Once you have a student loan, you’ll be starting to accumulate a credit history, so it’s wise to make sure that your credit history accurately reflects how you’ve met your obligations.

4. Unexpected healthcare costs

According to the U.S. Centers for Disease Control and Prevention, Americans made over 140 million visits to emergency rooms in 2016, the latest year for which statistics were available. While some individuals accounted for more than one of these visits, each of those 140 million occasions is a potential cause of lingering financial problems.

As Dr. Padawer points out, “When you appear for services in the emergency room, you may not even be conscious of the obligations you are taking on. Because the third-party payer system is complicated and takes time, consumers have a hard time following whether one piece of the emergency room visit or another will or will not be paid.”

Solution: According to Dr. Padawer, the law was recently changed so that medical obligations can’t be reported to credit agencies for six months, but even that breathing room is not always a solution. However, an informed consumer can have more tools to deploy to limit the credit history damage.

“You have privacy protections relevant to HIPAA that can be leveraged in controlling credit reporting,” says Padawer. “There are also protections pursuant to the Fair Debt Collection Practices Act.”

When contacting a hospital or other creditor about obligations incurred due to an emergency room visit, Dr. Padawer advises going beyond the general “1-800 customer helpline” and instead talking to a supervisor. The higher up the ladder you go, the more likely it is you may find someone with the authority to make a judgment call in your favor, especially if that person is sensitive to the potential negative publicity associated with taking a hard line against someone who has suffered a medical misfortune.

5. Unemployment and its lasting impact

There are currently less than 5.9 million Americans unemployed, but back in 2009 and 2010, when the economy was still reeling from the aftermath of the Great Recession, that number peaked at over 15.3 million.

For many people, even a temporary stint of unemployment can do lasting damage.

“Unemployment can have terrible consequences for a credit report if you don’t have at least a month’s worth of reserves,” warns Dr. Padawer. “When people do lose their jobs, they find they have not given enough thought to maintaining a reserve that will sustain them for any period at all. What often happens is that people think they’ll build an emergency fund someday, but they don’t get around to it.”

Getting caught short can quickly compound into worse problems when an unemployed person is desperate to borrow money to tide them over. “Historically, when people who are unprepared get into financial trouble, they often turn to payday lenders, pawn shops, and the like for really expensive credit,” observes Dr. Padawer.

This not only increases the financial hole for unemployed people but can lead to lasting damage to their credit reports. “Typically, payday lenders do not report to national credit bureaus, but the collection agencies that buy out those loans do report.”

Solution: Building an emergency fund before you need it can allow you to avoid the kind of quick fixes that only worsen your financial and credit reporting problems.

Still, as Dr. Padawer notes with respect to all of these common causes of financial difficulties, “some things you can prepare for, and some things you can’t.”

If you can’t avoid a financial problem, Dr. Padawer suggests attacking it head-on and being informed: “What you can do is when you face a financial problem, do your due diligence. Spend some time researching and understanding what your rights are and knowing how others have faced the situation.” Then, take swift action to address financial challenges, such as:

- Explaining your circumstances and asking for additional time to meet your obligations.

- Working out a debt repayment approach that you can manage, such as lower payments over a longer time-period.

- Negotiating a debt settlement where a portion of your debt is forgiven.

Money troubles rarely go away without impacting your credit history, so it is generally best to pursue a solution you can live with as rapidly as you can.